Project Overview

Building the Future of Employee Equity

The Challenge

Traditional equity management was fragmented, complex, and often opaque to employees. Companies struggled with manual processes, compliance issues, and poor employee engagement with their equity benefits. Employees frequently didn't understand their equity value or how to access it, leading to decreased motivation and retention.

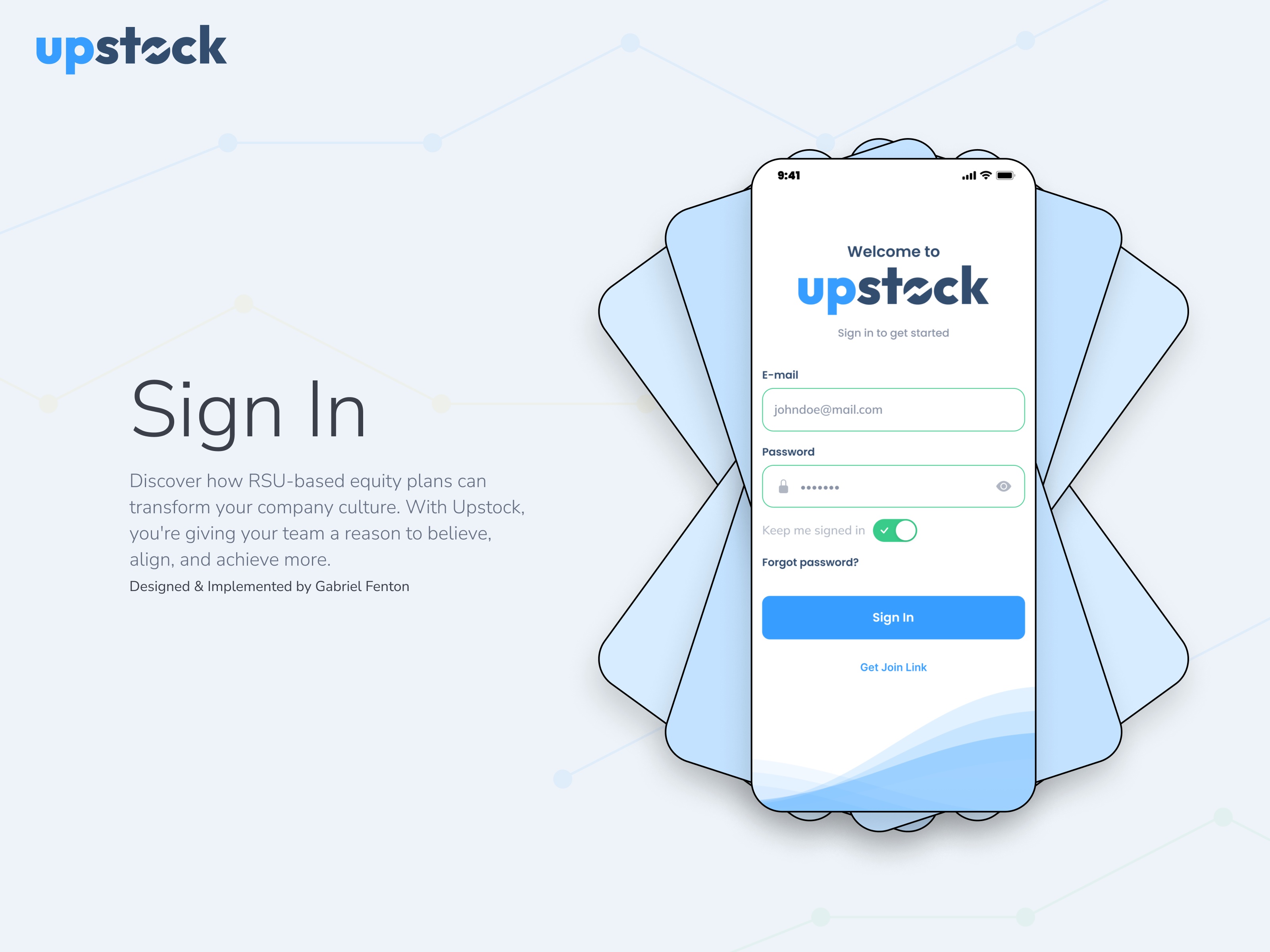

The Solution

We designed and built a comprehensive equity platform that simplifies RSU management for both companies and employees. The platform provides real-time equity valuations, automated vesting schedules, seamless selling capabilities, and transparent reporting—all wrapped in an intuitive user experience that makes equity accessible to everyone.

The Impact

The platform transformed how companies and employees interact with equity, resulting in 300% year-over-year revenue growth, over $200M in equity transactions processed, and 87% customer satisfaction. Employee engagement with equity benefits increased by 400%, and company onboarding time decreased by 75%.

My Role & Responsibilities

Leading Product Strategy & Execution

Product Strategy

User Research & Design

Product Execution

Growth & Optimization

Design Process

From Research to Implementation

Discovery & Research

Understanding the Equity Ecosystem

We conducted extensive research with employees, HR leaders, and finance teams to understand pain points in equity management. Through 50+ interviews and surveys, we identified key challenges: lack of transparency, complex processes, and poor user experience.

Problem Definition

Defining Core User Needs

Based on our research, we defined three core user personas: The Engaged Employee (wants transparency), The Busy HR Manager (needs efficiency), and The Compliant CFO (requires accuracy). Each persona had distinct needs that informed our feature prioritization.

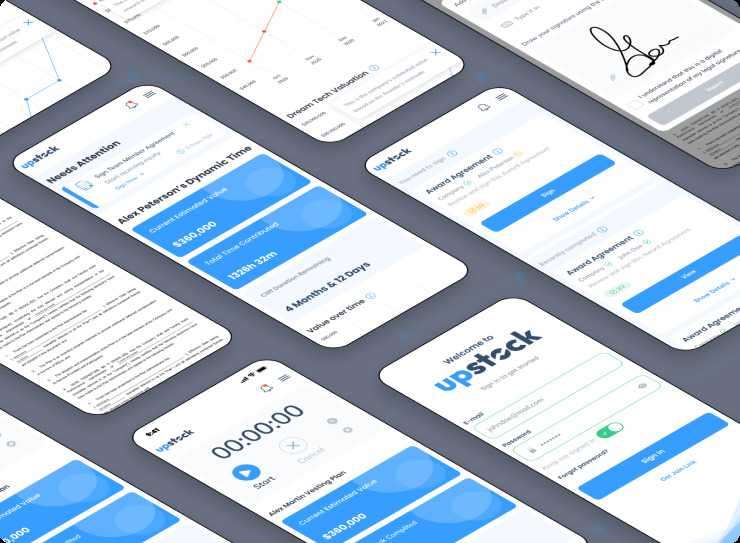

Design & Prototyping

Creating Intuitive Solutions

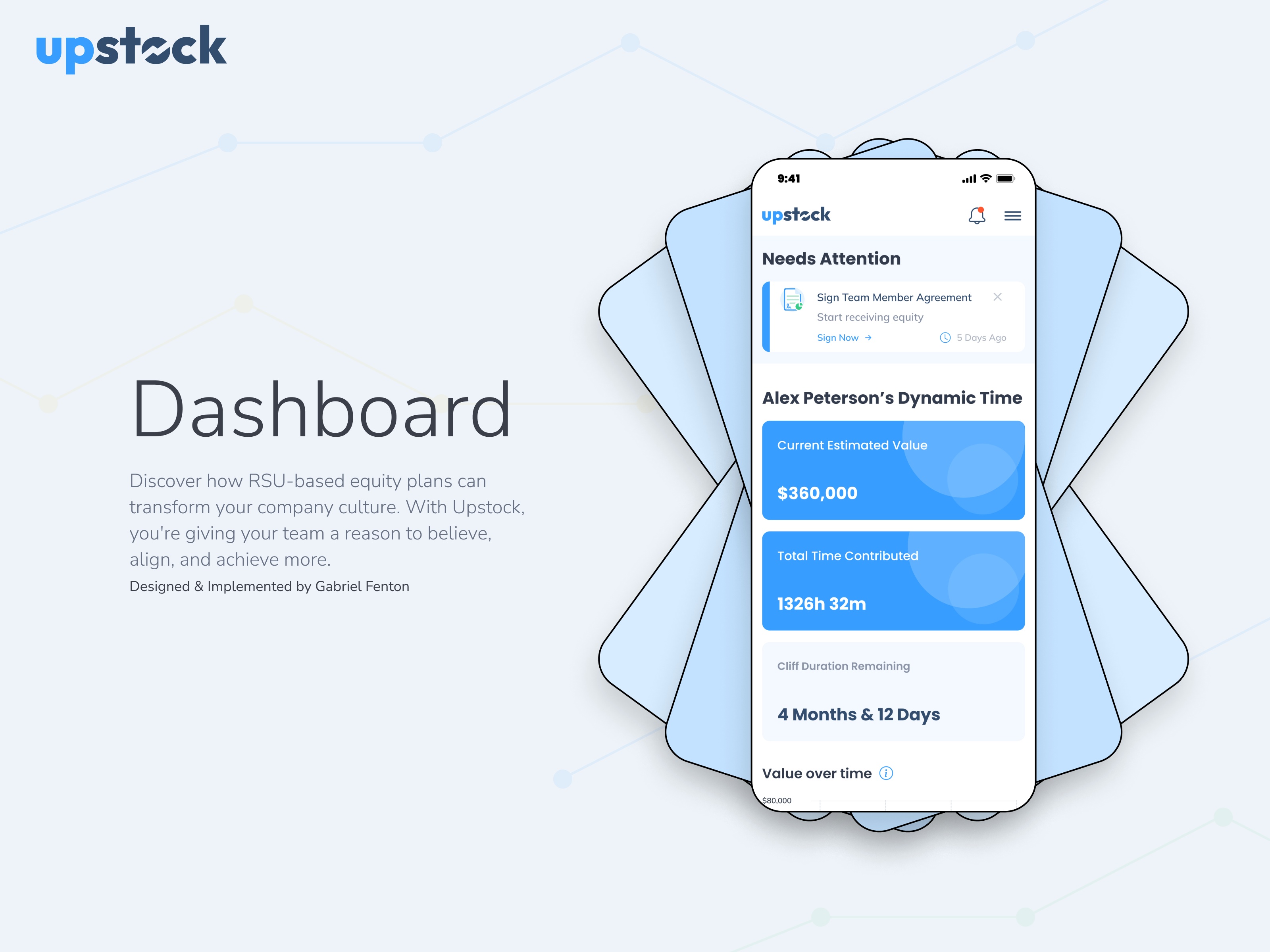

We designed a clean, dashboard-driven interface that provides real-time equity valuations, clear vesting schedules, and one-click selling capabilities. The design emphasized transparency and simplicity, making complex financial concepts accessible to all employees.

Development & Testing

Building for Scale & Security

Working closely with our engineering team, we built a secure, scalable platform that integrates with existing HR systems and financial institutions. We implemented robust testing protocols and launched a private beta with 5 companies to validate our approach.

Launch & Optimization

Scaling Success

Post-launch, we focused on user acquisition and platform optimization. Through continuous A/B testing and user feedback, we improved key metrics: reduced onboarding time by 75%, increased engagement by 400%, and achieved 87% customer satisfaction.

Key Features & Solutions

Innovative Solutions for Modern Equity Management

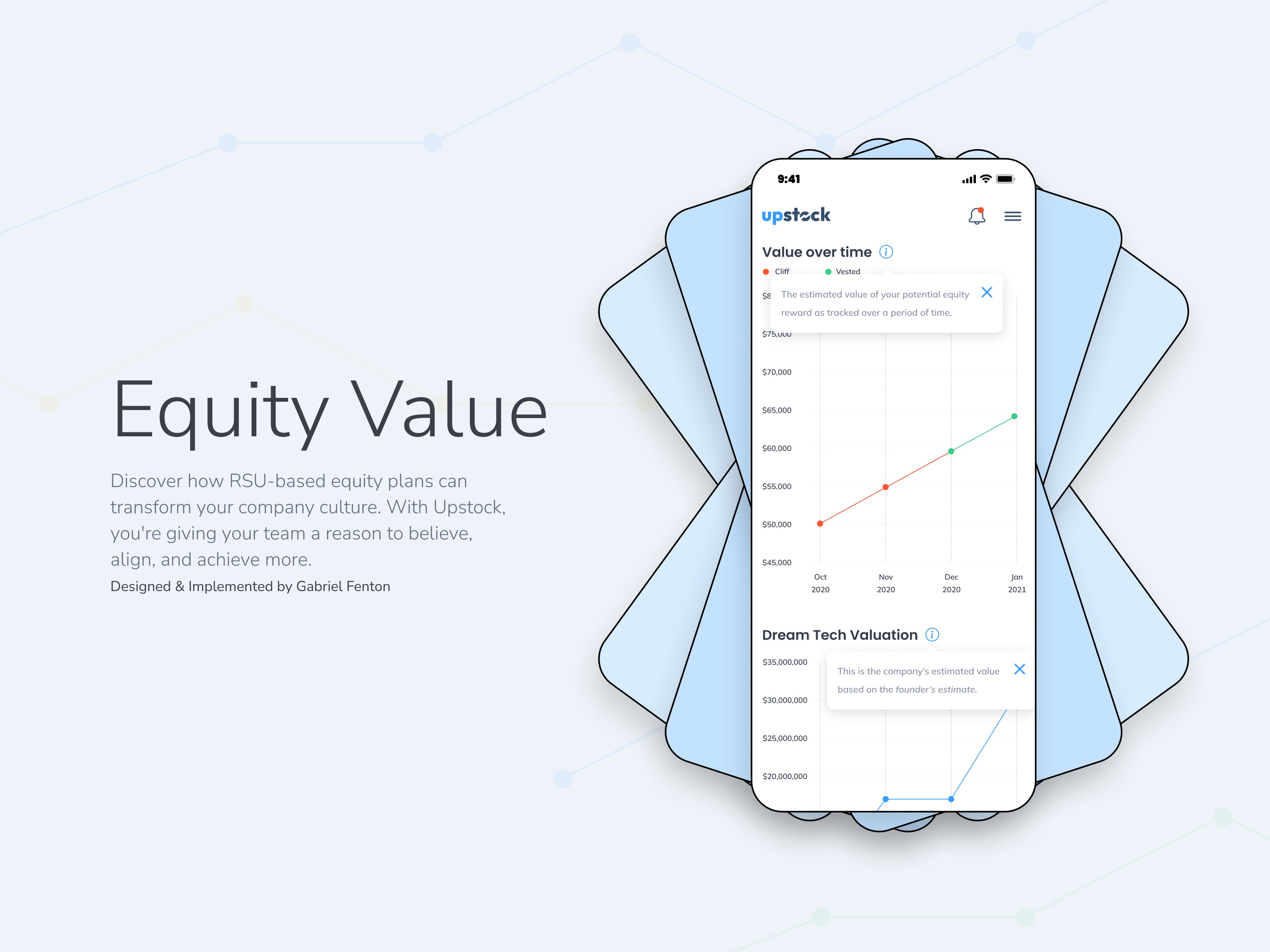

Real-time Equity Valuations

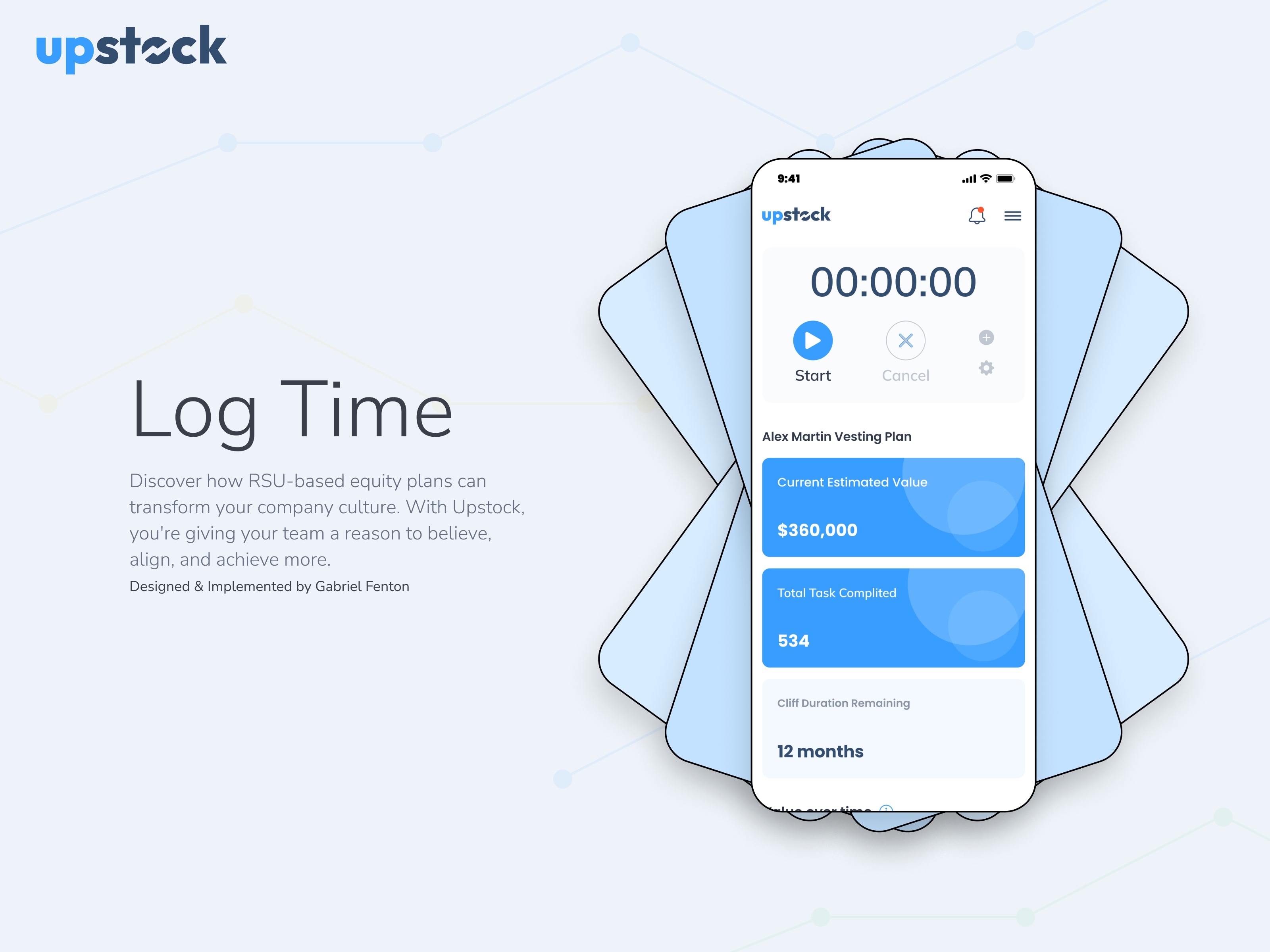

Employees can see their equity value updated in real-time based on company valuations, with clear projections and historical trends.

Automated Vesting Management

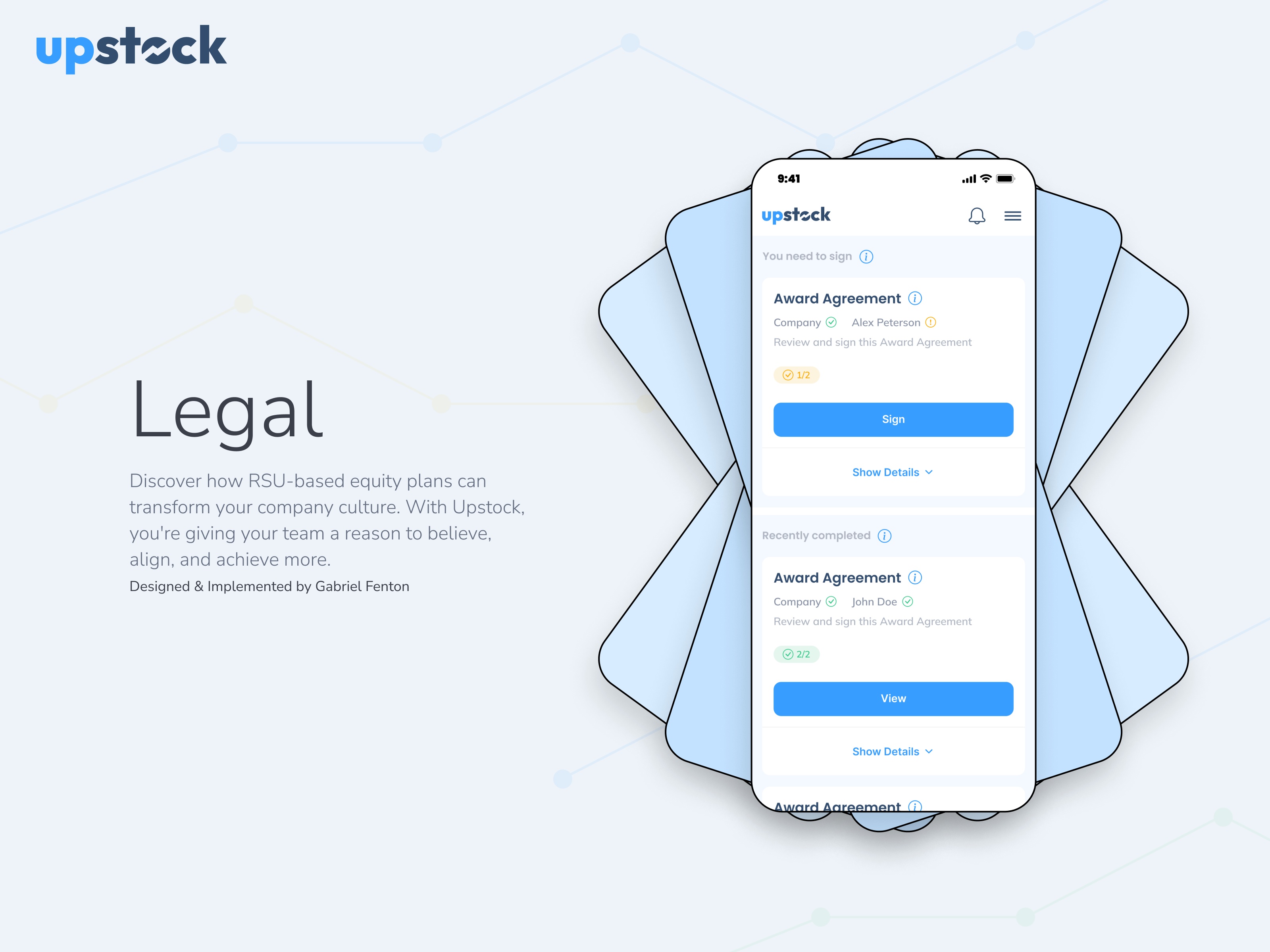

Automated tracking of vesting schedules with notifications and visual progress indicators, eliminating manual calculations and errors.

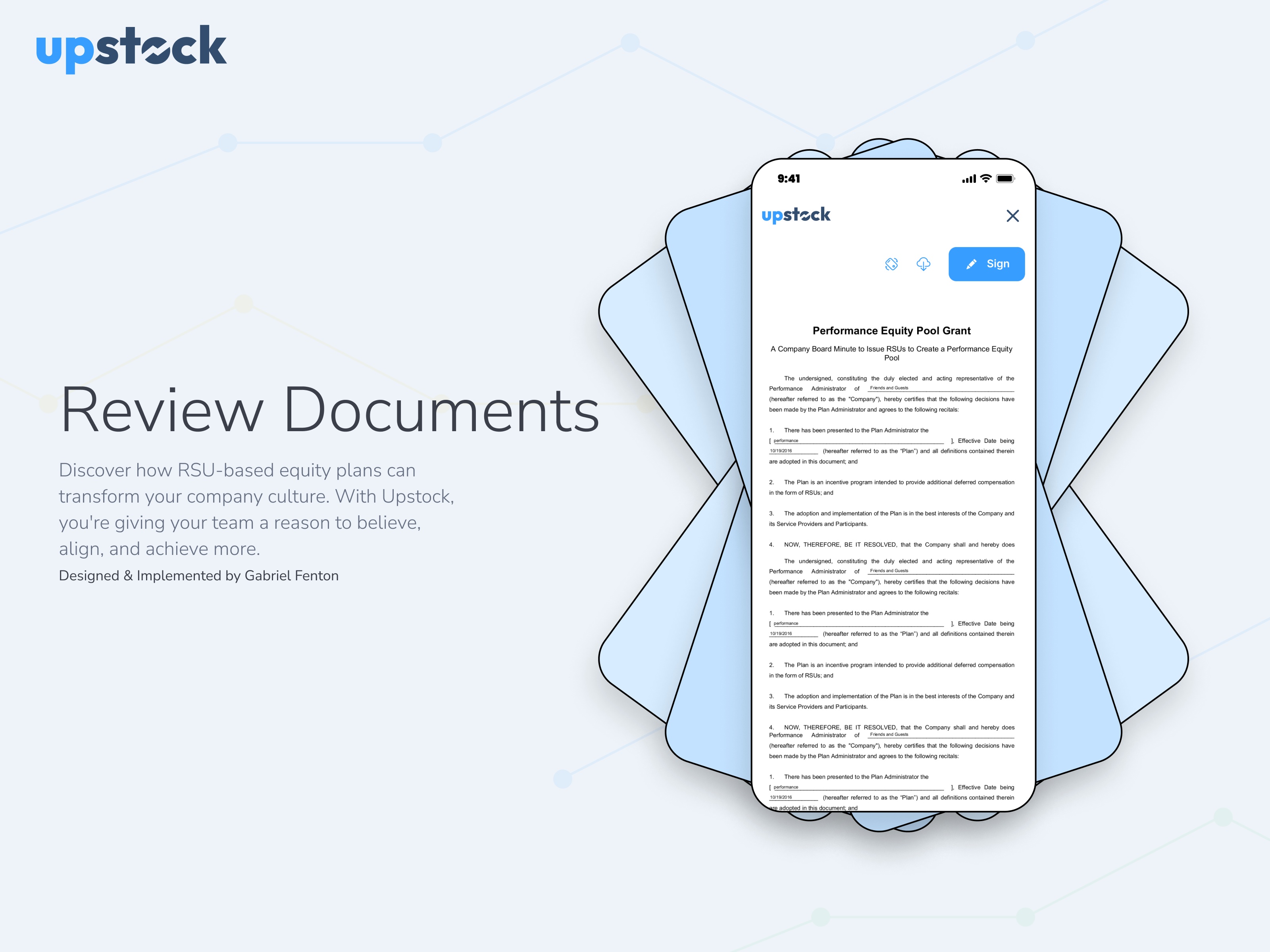

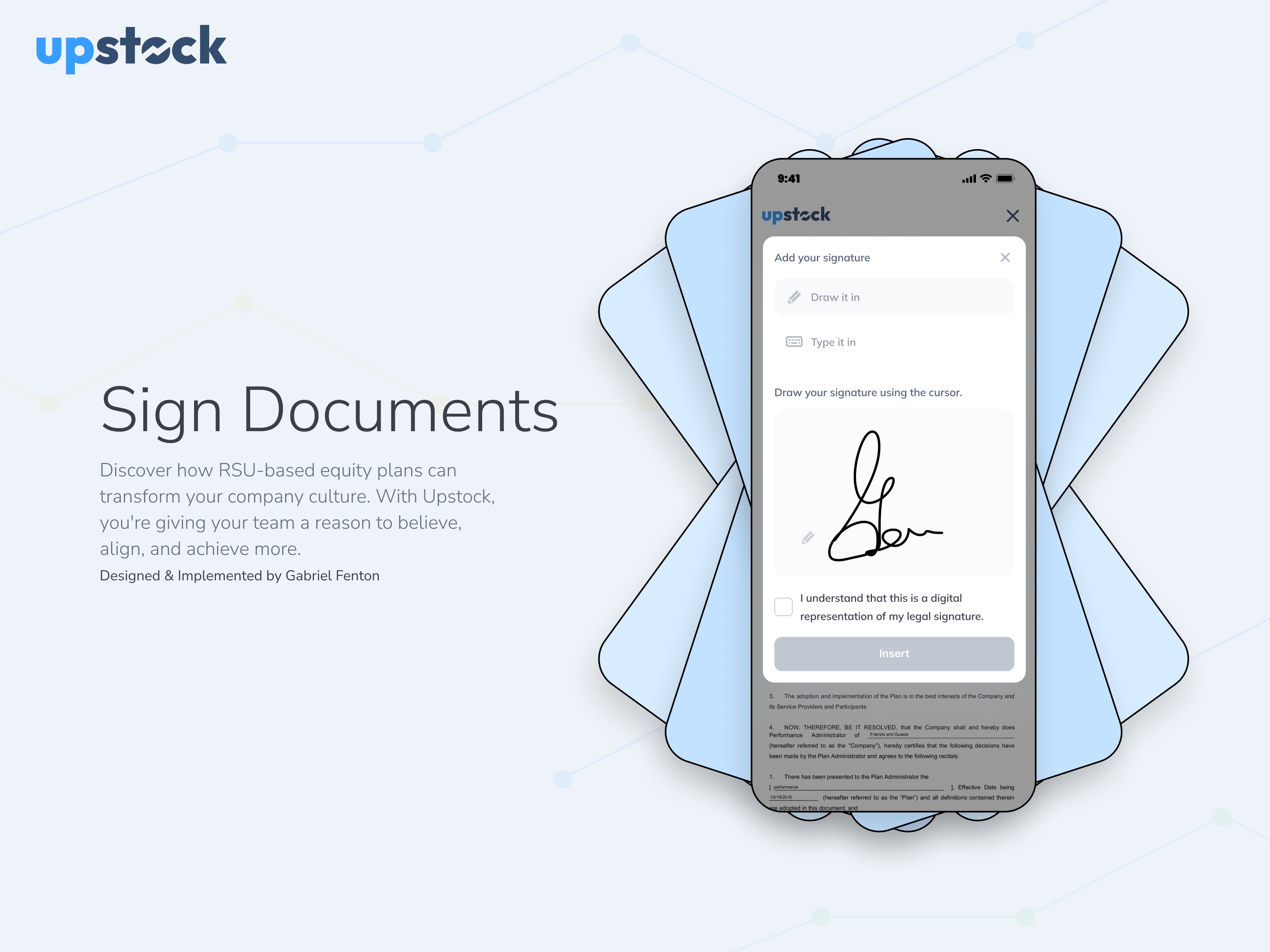

Seamless Equity Transactions

Employees can sell vested shares with a simple, guided process that handles all legal and tax implications automatically.

Compliance & Reporting

Comprehensive reporting tools for finance teams with automated compliance checking and detailed audit trails.

Results & Impact

Measurable Success Across All Metrics

Business Growth

User Experience

Platform Performance

Key Learnings

Insights from Building a Fintech Platform

Regulatory Complexity Requires Early Planning

Financial regulations add significant complexity that must be considered from day one. We learned to involve legal and compliance teams early in the design process, which saved months of rework later.

User Education is Critical for Adoption

Many employees had limited understanding of equity concepts. We invested heavily in educational content and onboarding flows, which dramatically improved engagement and satisfaction.

B2B2C Requires Dual Focus

Serving both companies (buyers) and employees (end users) required careful balance. We learned to design workflows that satisfy admin needs while prioritizing employee experience.

Data Security Cannot Be an Afterthought

Handling sensitive financial data required implementing security measures from the ground up. We achieved bank-level security through careful architecture and regular audits.

Client Testimonials

What Our Users Say

Gabriel was the driving force behind Wonder's early success. His tireless work ethic, strategic vision, and ability to rally the team made him the glue that held everything together.

Gabriel was an amazing mentor who helped me grow so much as a UX/UI designer. He taught me the importance of keeping designs consistent and always explained the reasons behind his decisions.

Ready to Build Something Amazing?

Let's discuss your project and explore how strategic product management can drive meaningful results for your business.